Making the most out of your college experience

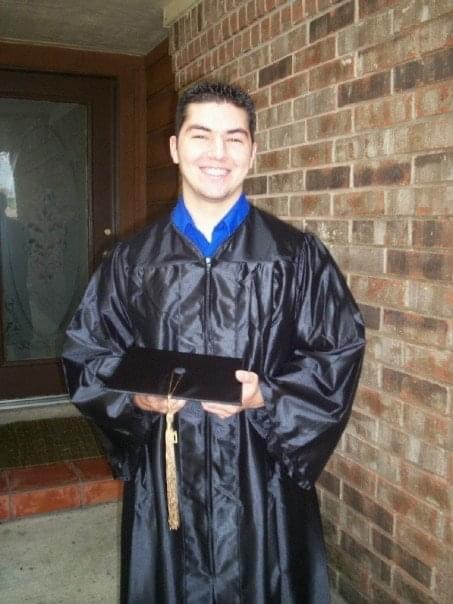

Broadway Banker Jacob Cavazos, SVP, Community Reinvestment Manager and University of Texas at San Antonio graduate, shares his financial tips (and some not so financial tips) for today’s college students.

Even though 20 years have passed, I remember my first day at the University of Texas at San Antonio like it was yesterday. The smell in the air, the grass under my feet—It was a celebratory feeling of starting a new journey as a UTSA student full of possibilities and excitement. As I made my way onto campus, a literal celebration was taking place. An event to welcome students back to school was underway. Music blared and booths lined the middle of campus, each offering fun food, drinks and giveaways. It was a great time, and I couldn't help but feel like I was in the “right place.” I remember thinking, ‘This is too cool! Is this what college is like every day?’ That day was the beginning of the most memorable and challenging four years of my life.

As I think back on my college experience with overwhelmingly positive memories, I think about the things I wish someone would have told me before I entered the world of full independence, responsibility, game days and money management. It really is all about keeping balance, making the best choices, and embracing every opportunity that comes knocking.

When it comes to balancing your free time with school assignments and your personal finances, there are a few pieces of wisdom I think are important to help you make the most of your college experience and set you up for success post-graduation.

Create a budget and stay true to it.

Although creating a monthly budget can sound overwhelming, having a game plan for how much money comes in and goes out every four weeks is half the battle. Every adult you know in your life does some version of budgeting. Whether it’s via online banking, mobile banking apps, or the good old pen-to-paper method, budgeting your income and expenses is something that you will be doing for the rest of your adult life. Why not start great habits now? Unexpected expenses will come up from time to time, but if you have a basic plan for what you expect to spend each month versus what you expect to earn you will be able to navigate those curve balls with greater ease and adjust your spending to cover new costs.

Avoid overdraft fees in your checking account.

It can be incredibly frustrating, not to mention costly when you accidentally overdraw your checking account. Knowing that your next deposit will partially be eaten up by the negative balance in the account really hurts. Talk to your bank about “opting out” of overdraft courtesy on your checking account. By doing so, your debit card will decline if the transaction you are trying to make goes beyond your available dollars. With that, you avoid overdrawing your account and the fees that come with it. Another money-saving trick is linking your checking account to your savings account for ‘overdraft protection.’

Use credit cards responsibly to build positive credit.

As a college student, you are presented with opportunities to open credit cards. Be cautious of the free giveaways and discounts that retail stores and mail solicitations advertise to you. The free t-shirt or 20% off discount might sound worth it in the moment but racking up multiple credit card bills in your name can cause chaos. However, when used responsibly, credit cards can be a great financial tool to build positive credit.

Making consistent, on-time payments on credit cards can boost your credit rating, but if your credit spending gets out of control, monthly payments and accumulated interest can become a real problem. If you decide to get a credit card, try to follow these quick tips:

- Pay off your balance every month to avoid paying interest on your credit card purchases. Resist the temptation to spend more than you can pay for any given month, and you’ll enjoy the benefits of using a credit card without interest charges.

- Use the card for needs, not wants! It’s incredibly tempting to just the card on a “good time” but remember that the credit card is a temporary loan to yourself. Use it as a tool to help you, not hurt you.

- Never skip a payment, and always try to pay more than the minimum payment. Missing a payment could result in a late fee, penalty interest rates and a negative impact on your credit score. Only making the minimum payment on a card exponentially increases the amount of time you will be paying on the credit balance, and in turn, greatly increases the amount of interest you will pay.

- If you are unable to pay off your balance in full each month, then try to stay under 30% of your total credit limit. For example, if your limit is $1,000 keep your balance under $300. Doing so will help keep your credit score healthy.

Start paying back your student loans quickly.

Although you typically don’t have to pay back your student loans right after graduation, getting a head start on repayment could ease the burden on your future finances. When you’re creating your monthly budget, try to work in a line item of paying your student loan debt. Unless you have subsidized loans, your debt will be quietly growing the entire time you’re in college. But if you can swing small or interest-only payments as a student, you can avoid long-term interest rates post-graduation.

Apply for scholarships every year.

Undoubtedly, scholarships are a remarkably beneficial resource when paying for college, but the only shot at winning the scholarship is to apply. With the many things you are trying to prioritize (classes, exams, books, living arrangements, campus groups, social life) it can be hard to keep scholarship deadlines top of mind. Remember to notate those deadlines on your calendar, especially the ones that do not auto-renew. Many scholarships allow you to apply as many times as possible when you meet eligibility so remember to continue applying.

Exercise and eat healthy.

When the semester gets underway everything can become overwhelming. The cumulative workload from all your classes, labs, and projects can cause stress that can become hard to cope with. As simple as it sounds, what you put into your body can affect your performance, and most importantly, your overall health. Try to include fruits and vegetables in your daily diet and look for healthy snacks to store in your dorm room or apartment.

Reflect on your goals and celebrate your wins.

College is a time of enormous personal and professional growth, so make sure to step back and reflect on your goals from time to time. Even if you’re still exploring majors and careers, take time to celebrate your accomplishments and map out your goals. This goes for your financial goals as well. For example, if you finish out the month under budget, celebrate by splurging on a fancy coffee or saving that money towards your next summer vacation.

Get involved.

Whether it is sports, volunteerism, or Greek life that you are passionate about, explore different things and learn about different causes during your time in college. While studies and a degree are important, building relationships and networking with your peers will build lasting connections. I met several of my best friends in college and we have continued our friendship for years.

Invest in yourself.

Your college education is an investment in yourself, and you want to get the greatest possible return. It is an exciting period in your life where you learn to juggle studies, social life, and work, learn to live independently and get to know amazing people. Go to all your classes and take advantage of the services your college offers to help you grow your network, explore careers, or find scholarship awards. By making use of these resources, you can set yourself up for success in college and beyond.

Broadway Bank has proudly supported college students and local education initiatives since 1941. Follow us on Facebook, Instagram, Twitter and LinkedIn to receive scholarship, internship and job announcements when available.