Investment Management Newsletter - 2nd Quarter 2024

Exactly as Planned

While the presidential debate on June 27, 2024, did not go as planned for Democrats, causing many to question if President Biden should be replaced as their nominee, the financial markets, on the other hand, seem to be moving along at a typical election year pace. During a typical presidential election year, the first quarter starts off strong as both sides are excited about the prospects of winning. This excitement diminishes in the middle of the year as the spotlight moves toward each candidate’s flaws, leading to softer returns in the second and third quarters. Once the election results are determined and uncertainty subsides about who will be the next president, markets tend to end the year positively. So far, the markets seem to be on script, with a strong first quarter exceeding expectations and a second quarter, that, while solid, has started to show some cracks. While the full fallout from this year’s first presidential debate has yet to be seen, it has shown us that surprises can be expected this election cycle. Although we have an idea of how the year will end, the final script can change at any moment.

Not Across the Board

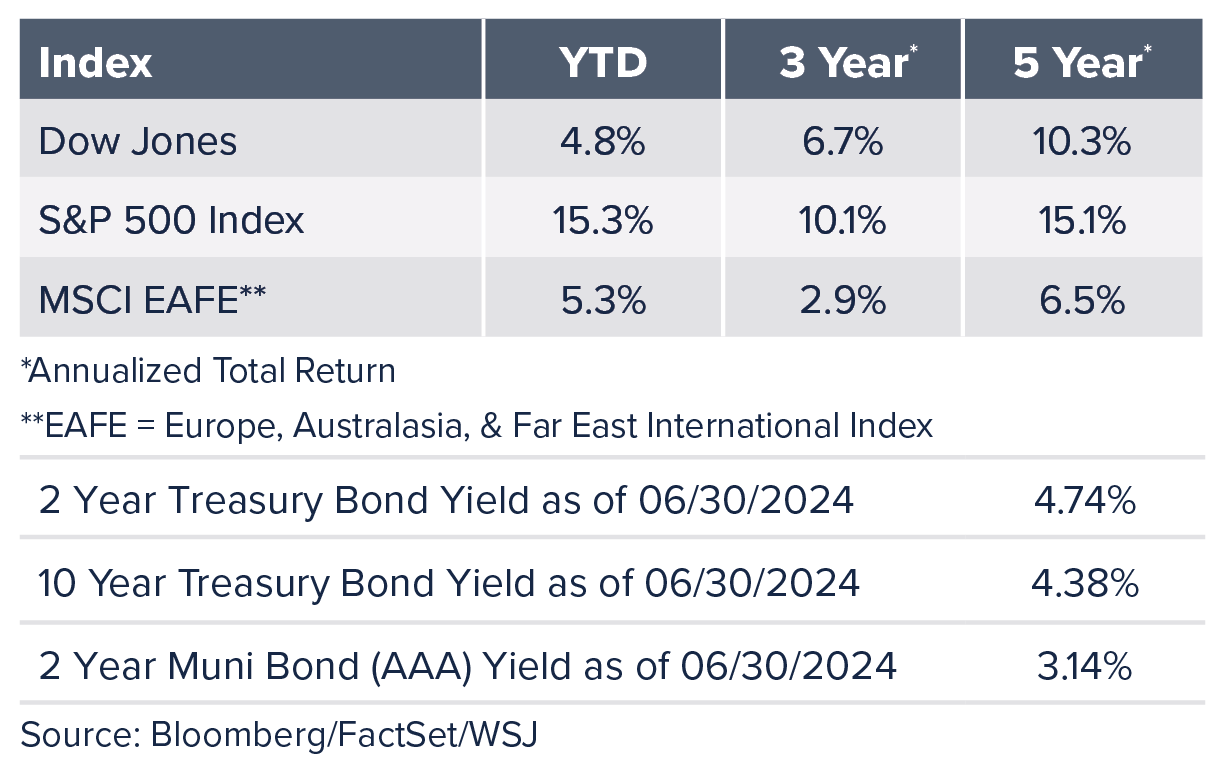

The S&P 500 added 4.3% in the second quarter bringing its year-to-date return to 15.3% with half the year remaining. Looking deeper into the details, Information Technology, Communication Services and Utilities sectors were the only three sectors that had total returns above 4.0%. Other than the modest gains from Consumer Staples and Consumer Discretionary, the remaining six sectors saw losses of 1.0% or more. Even though most sectors slowed down from the first quarter, the theme that persisted was the continued growth of some of the largest market capitalization stocks. For the first time, the U.S. now has three companies with market values above $3 trillion (Apple, Microsoft and NVIDIA). Even with April being the worst month so far this year for S&P 500 returns, we haven’t seen a daily decline of more than 2.0% during any trading day of 2024. In fact, it has been over a year since the S&P 500 last saw a daily decline of 2.0% or more. This shows that overall investors have been optimistic and volatility has been low.

Beyond large cap equities, the S&P MidCap 400 and S&P SmallCap 600 each ended the quarter down 3.5% and 3.1%, respectively, with the MidCap up 6.5% and the SmallCap down 0.7% year-to-date. International stocks were mixed with the MSCI EAFE Index falling 0.4% during the quarter and the MSCI Emerging Markets index rising 5.0%. Oil, as measured by the price for West Texas Intermediate crude declined 2.1% for the quarter while gold saw an increase of 5.3%.

Bond Rates

The 10-year Treasury rate ended the second quarter at 4.38%, which is higher than where it started the year at 3.88%, but lower than it was at its peak of 4.70% for the year on April 25. The movement lower in yields caused the Bloomberg U.S. Aggregate Index to increase 0.1% during the second quarter. Riskier credit as measured by the Bloomberg U.S. Corporate High Yield Index was up 1.1% during the quarter.

Making the Cut

Market expectations of rate cuts are finally in line with the Fed after the market was previously pricing in up to six rate cuts while the Fed originally thought there would be three cuts this year. Both seem to agree now that two rate cuts would be appropriate for the year, with September and December being the most likely months for those cuts to occur. The timing and likelihood are still largely dependent upon whether employment remains stable and inflation continues to progress toward the Fed’s 2.0% goal. Annual core inflation, which excludes food and energy, has seen a steady decline from its September 2022 peak of 6.6% to the most recent reading of 3.4% for May 2024. Meanwhile, unemployment has remained relatively stable, increasing from its low of 3.4% in April 2023 to 4.1% in June 2024. While the Fed doesn’t have a specific target for this, many economists believe an unemployment rate of 3% to 5% to be normal and not restrictive to a growing economy. Chairman Jay Powell has explained the balance the Fed is trying to achieve lies between waiting too long to cut rates at the cost of economic activity and employment, and cutting too quickly, undoing much of what they’ve already accomplished to reduce inflation and having to start over.

Whenever the Fed does decide to cut rates, it will affect the bond market and mortgage demand. The Fed moving the Fed Funds rate down could be the catalyst that leads to a return of a normal yield curve. The yield curve has been inverted, with longer rates lower than short-term rates, for almost two years. Many homebuyers have also been on the sidelines waiting for mortgage rates to go down. Whether lower mortgage rates will lead to increased demand or if higher prices and relatively low inventory continue to hamper demand has yet to be seen.

Short-Term Volatility Ahead

As we get closer to the end of this election cycle, we can expect more surprises from both sides that could lead to fluctuations in the market. Our plan is to be aware of events causing short-term swings but to continue to invest for the long-term while, at the same time, avoiding unnecessary risks.

For questions or comments on any of the topics included in this newsletter, please contact Broadway Bank’s Wealth Management team at [email protected].