Investment Management Newsletter - 3rd Quarter 2021

As the quarter began, the nation was returning to normalcy with the pandemic showing signs of retreat. Within weeks, we saw an upsurge of the Delta variant. Consumer activity slowed as many resumed their more cautious prior behavior. Some local governments re-implemented restrictions, and as a reflection of increasing uncertainty, markets became skittish. As fall arrived, the virus’ surge peaked, and the economic recovery seemed to be getting back on track. Nonetheless, effects of the pandemic, such as strained supply chains, rising inflation, labor market imbalances, and a potentially less accommodative Federal Reserve, remained.

Inflation: Transitory or Enduring?

Inflation continued to tick upwards due to strong demand amid disrupted supply chains and higher labor and transportation costs. Year-over-year, inflation, as measured by the Consumer Price Index (CPI), had been tracking above 5% since May, with the most recent reading at 5.3% (4.0% excluding food and energy). Gains in inflation over the past year have been driven by energy (+25.0%), used cars and trucks (+31.9%), and food prices (+3.7%). Shelter costs, representing about a third of CPI, rose 2.8%, but do not yet reflect the increase in housing prices of 19% over the past year.

The Fed’s preferred inflation measure, the core Personal Consumption Expenditure Index, is up 3.6% year-over-year, well above their long-term target of 2% and at a 30-year high. However, as July and August CPI data were released, Fed officials assessed the increases as transitory stating inflation is “unlikely to persist as current bottlenecks unwind.” Even so, trends indicate inflation will remain elevated as holiday shopping gets underway. Unless household incomes increase at least proportionally, inflation pressures consumers as businesses pass along higher costs, reducing sales volume. Businesses which are unable to pass on higher costs see less profitability which leads to lower stock prices.

Brinksmanship in Washington

Late in the quarter, President Biden signed a resolution to avert a government shutdown, calming the markets somewhat. Legislators spent the quarter working on spending initiatives, which include a potential $1.2 trillion infrastructure plan and a $3.5 trillion social policy and climate bill. At issue for investors is the proposal to partially fund the bills through tax code changes which could increase capital gains taxes and income taxes for corporations and high-income individuals. The process is fluid and likely to hold the markets’ attention in the weeks ahead.

Wake me when September's over

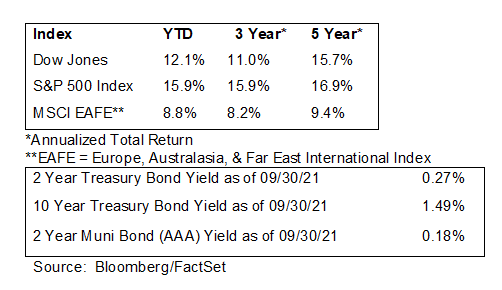

The S&P 500 continued upward by 0.6% for the quarter, attaining its sixth consecutive quarter of gains. This leaves the index up 15.9% year-to-date. September is seasonally the worst-performing month for equities and is ranked as the worst-performing month for the S&P 500 over the last 20 years.

After seven months of positive equity returns, September brought a decline of 4.7%, the Index’s worst monthly performance since March 2020. In the quarter’s last four trading sessions, the S&P 500 declined 3.3%. The technology- and growth-heavy NASDAQ 100 declined 5.7%, while the Dow Jones Industrial Average fell 4.3% for the month, though it was up 12.1% year-to-date.

The Energy sector lost 1.7% after strong increases of 30.8% and 11.3% in the first and second quarters, respectively, posting a year-to-date return of 43.1%. Financials rallied 2.7% on the quarter, hitting 29.0% year-to-date, while Communication Services stocks just managed to stay positive with a quarterly return of 1.6%. Among top performers in our portfolios were Diamondback Energy, Morgan Stanley, Alphabet (Google), and Chevron.

The Industrials sector demonstrated vulnerability to supply chain logjams, down 4.2% for the quarter, though up 11.5% on the year. Utilities closed up 2.0% for the quarter but were the worst performing sector with a 4.2% year-to-date return. Some softer performers in our portfolios included PPG, Verizon, Activision Blizzard, and Starbucks, all of which saw their share prices flat or lower for the first nine months of the year.

International markets ended the quarter in the red, with the MSCI EAFE down 1%, its first quarterly first loss since early 2020.

Fixed Income and Federal Reserve

Fixed income investors continue to face low yields with the combination of easy monetary policy and the recovery leaving the 10-year Treasury yield between 1.2% - 1.5% throughout the quarter. A year earlier, it was at 0.68%. The Bloomberg U.S. Aggregate Bond Index dropped 0.9% for the quarter and was down 1.6% year-to-date.

Bear in mind, long-term yields are set by the market, whereas short-term rates are closely linked to actions of the Fed. Recently, the Federal Open Market Committee announced a potential rate hike by the end of 2022, which would be the first increase in the federal funds rate above near-zero since March 2020. Higher short-term rates can help combat inflation in the present and keep it from becoming a longer-term phenomenon.

Commodities

Commodities continued their bullish run. Since March 2020’s low, the Bloomberg Commodity Index is up 70.0%, and 29.1% year-to-date. West Texas Intermediate crude oil prices gained 14.1%, closing at $75.03 a barrel, on increased demand expectations and are up 55% year-to-date.

Looking Forward

We may see some turbulence in the year’s final quarter. Toward the end of September, analysts began cutting expectations for earnings, with the key to this earnings season being management views on pricing, supplies, deliveries, and labor. Stock market gains for the near-term may be subdued until the benefits from fiscal stimulus are fully realized and the economy stabilizes further. Meanwhile, we remain aware that market volatility can present potential investment opportunities.

Should you have any questions or comments, please email us at BWealthManagement@broadway.bank.

Written by Broadway Wealth Management's Portfolio Managers.