Investment Management Newsletter - 1st Quarter 2023

Bank Sprint

The regional bank event in mid-March seemed much more like a bank sprint than a bank run. Within days, Silvergate Bank decided to wind down its operations, and two other major banks, Silicon Valley Bank (SVB) and Signature Bank, were shut down by regulators. Banks typically invest their excess deposits in longer-dated, high-quality bonds to earn an amount of interest greater than what they pay on the deposits. Bond prices decline as interest rates increase. The Federal Reserve has raised interest rates at a historically rapid rate and that had a major impact on banks’ investments. As Silvergate lost deposits, they were forced to sell their investments, realizing losses of about $1 billion. As their depositors learned that Silvergate was having to sell their investments at a large loss to meet the demands for withdrawals, even more of their depositors withdrew, ultimately forcing Silvergate to cease operations.

SVB experienced a scenario similar to that of Silvergate, though in an attempt to save itself, SVB tried and failed to raise money from the capital markets. In the process, its concentrated depositor base quickly moved funds to other banks. SVB primarily loaned money to and took deposits from venture capital start-ups and their founders. As these companies, funds, and executives rapidly moved their deposits to other banks, SVB had a capital hole that it could not fill, and the FDIC put SVB into receivership.

As this was unfolding, Signature Bank was also showing signs of stress. Like Silvergate, but to a lesser extent, it was known to take cryptocurrency deposits and to have a concentrated loan portfolio. Toward the end of the day on Friday, March 10, it saw an outflow of $10 billion in deposits. The FDIC quickly moved to shut down Signature Bank as well.

While the unease continued, domestic bank failures seemed to stop after Signature Bank failed. This happened as the federal government stepped in with several critical programs. First, the FDIC backed all deposits (even those above $250,000) at SVB and Signature Bank under a systemic risk exception. Second, the Fed created a new lending facility called the Bank Term Funding Program. This program allowed eligible depository institutions to pledge U.S. Treasuries, agency debt, mortgage-backed securities and some other assets as collateral. The difference is that banks could borrow cash against these assets at their par value (the value at which the securities mature) versus current market value. A depository institution could then receive the full future value of these bonds to meet their customers’ withdrawal requests. This would help banks avoid a capital deficiency and prevent further bank runs. While somewhat complicated, this shows how the bank run was stopped in its tracks and other imperiled banks, such as First Republic, Western Alliance, and PacWest, have managed to continue operating.

It is important to note why these three domestic banks quickly lost deposits and the trust of their customers. Each had a base of depositors and borrowers concentrated in a single industry. Silvergate, and to a degree Signature, catered heavily to cryptocurrency firms and depositors. Signature also had heavy exposure to New York real estate. SVB was narrowly focused on serving venture firms, their portfolio companies and the biotechnology industry. The difference between these banks and other regional and community banks such as Broadway is a diverse customer loan and deposit base. An additional risk SVB had was that approximately 95% of its deposits were uninsured, meaning a large proportion of its deposits were above the $250,000 per depositor FDIC insurance limit. Knowing their deposits were unprotected against a bank failure, many of their large depositors were quick to withdraw their deposits at the first sign of trouble.

The impact to Broadway’s Wealth Management clients from Silvergate, Signature and SVB was quite limited. Broadway had no direct exposure to any of the failed institutions. Broadway does hold some exposure to a couple of large regional banks in some of its portfolios, but the share prices of these banks were far less affected because of the quality of the banks. Broadway’s process for carefully vetting companies it invests in helps our clients avoid significant losses resulting from company-specific issues.

Smaller Increases

The Fed increased the Federal Funds Overnight Rate at both of their scheduled meetings this quarter. Both increases were 0.25% each so the top end of the range now sits at 5.0%, up 0.5% from the beginning of the year. The last raise took place after the bank run event even though a pause was debated at the Fed meeting. While it is not precisely known, many economists project that the bank run event and the subsequent tightening of credit standards would result in effects equivalent to a 1% interest rate increase. Thus, the bank run event did some of the Fed’s work on slowing the economy to fight inflation. As mentioned earlier, things were not business-as-usual at the Fed because they had to implement the Bank Term Funding Program on a Sunday night to restore the public’s confidence in the banking system.

Equities Recover Ground

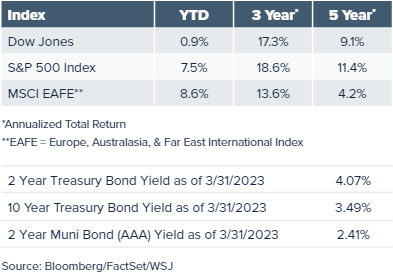

Despite the significant volatility during the quarter, the equity market had a strong bounce back from 2022. The S&P 500 gained 7.5% as Technology and Communication Services companies surged over 21%. Not surprisingly, Financial Services and Energy companies fared the worst with mid-single digit losses. As the Technology returns would indicate, growth stocks outperformed value stocks by 13.0% in a reversal from the prior year. Developed international stocks bested the S&P 500, returning 8.6%. Emerging market stocks gained 4.0%, which was higher than the 3.8% and 2.5% return for mid and small cap stocks, respectively.

Rates Drop

The 10-year Treasury bond yield fell 0.39% to 3.49% allowing a positive total return after a brutal 2022. The Bloomberg U.S. Aggregate Bond Index rose almost 3.0% as yields dropped. High yield and credit indexes performed slightly better as investors were willing to take more risk during the quarter. Interest rates exhibited their own bout of volatility, particularly around the bank run event. The MOVE index which measures the implied volatility of 1-month Treasury options reached its highest levels since the Great Financial Crisis during mid-March but moved lower to close out the quarter.

Alternative Assets

Other asset types registered performances like stocks and bonds but in a different manner. This helped to mitigate portfolio risk during the volatile quarter. Real Estate Investment Trusts gained 1.7%, propped up by falling interest rates, but remained muted over concern about commercial real estate loans that may be hard to refinance. Global Hedge Funds lost a quarter of one percent against an extremely volatile backdrop. Crude oil fell 5.7% during the quarter while gold gained 7.8%.

The Broadway Wealth Management Difference

The investment discipline and style of Broadway’s Wealth Management process again proved resilient during another volatile environment. By investing in only high-quality companies, Broadway’s Wealth Management clients were able to sidestep any direct exposure to the second and third largest bank failures in U.S. history. This test seemingly came out of nowhere, but it serves as a reminder that Broadway is always looking out for their clients’ best interests no matter how rapidly the economic and market environments are changing.

Should you have any questions or comments, please email us at [email protected].