Investment Management Newsletter - 1st quarter 2024

The Field is Set

After Super Tuesday on March 5, 2024, the presidential candidates for the November election were all but determined. This raises the question of which election result might be most beneficial to financial markets. Our intention is not to take a political stance, but to forecast different outcomes, so that we can be prepared and have the appropriate risk mitigation measures in place.

Typically, analysts look at past election cycles to determine what combination of political parties in government seats are best for future returns. Several generalizations can be summarized from this analysis. First, the best returns come from a divided government. If the House, Senate, and Presidency are not controlled by the same political party then enough checks and balances remain in effect to avoid radical policy changes. Logically, this makes sense as companies can develop corporate strategies with relative certainty of the status quo. Second, returns are no different under a Democrat president with a Republican dominated House and Senate compared to a Republican president and a House and Senate dominated by Democrats. In other words, the specific mix of parties making up a divided government does not yield significant differences in future stock prices. Again, it is the lack of political policy movement that is the key for corporations to effectively implement their strategic plans and reap rewards for shareholders. Third, trying to assign market gains based on policy actions from one party to another is always difficult as many policies take years to be implemented. Further, exogenous events like pandemics, credit cycles, wars, and monetary policy can overshadow policy in terms of financial market returns.

This presidential election we are focusing on a different factor that could have a significant effect on capital markets during and after an election. This factor is the degree of certainty of knowing who won. Reviewing the last two presidential cycles where the winning candidate was known within days, if not hours, of polls closing, the stock market rallied into the end of the year as companies knew how to plan for the next four years. After the 2020 election when Joe Biden became the president-elect, the S&P 500 rose 11.5% into year-end (11/03/2020-12/31/2020). Likewise, after Donald Trump became the president-elect, the S&P 500 rose 4.6% into year-end (11/08/2016-12/30/2016). During the 2016 presidential election, stock market futures were down almost double-digit percentages when Trump and Hillary Clinton were close in electoral college votes. As Trump pulled ahead and at almost the exact moment Clinton conceded, stock futures reversed losses and the markets finished with a good gain the day after election night. When Clinton conceded, the potential for a disputed election result vanished, as did the stock market’s concerns. Conversely, during the disputed election results of Bush v. Gore in 2000, the S&P 500 fell 7.8% through year-end (11/01/2000-12/29/2000). Investors were not interested in buying stocks during this period of an uncertain election outcome. It is impossible to know with certainty how a presidential election will turn out and how markets will perform. We acknowledge this uncertainty and our attention to risk considerations has helped our clients during past elections.

Off to the Races

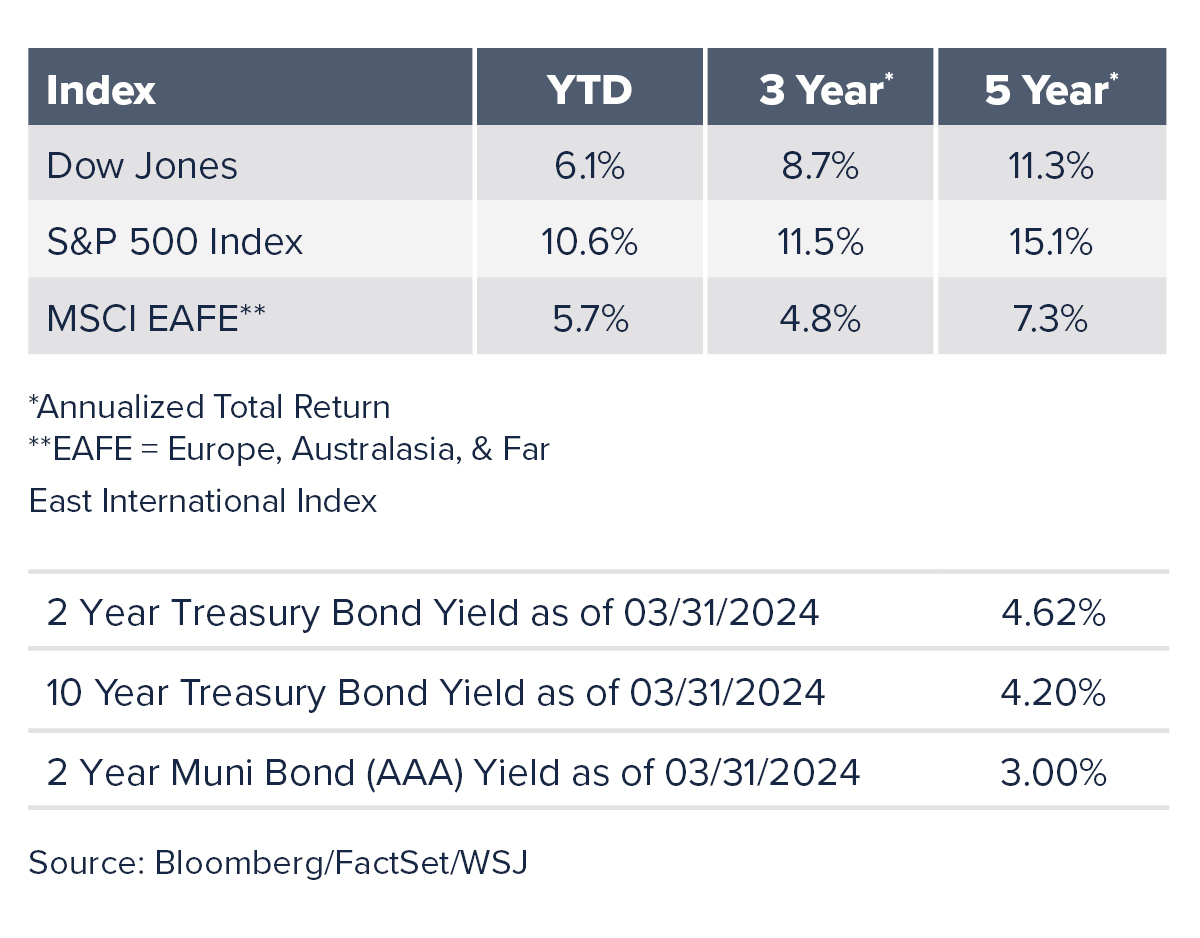

The recovery of 2023 continued into the first quarter of 2024, as the S&P 500 rallied 10.6%. This amounts to roughly a full year of expected returns generated over just three months. The S&P 500 set new all-time highs multiple times during the first quarter. What few down days did occur, the S&P 500 fell by a very small percentage, never falling more than 2.0%. General trends from the prior year remained intact as larger companies outperformed smaller companies with the S&P MidCap 400 and S&P SmallCap 600 finishing 9.9% and 2.4%, respectively. Communication Services and Technology outpaced other sectors and this quarter Energy joined the mix as oil prices rose 16.1%. Real Estate was the only sector to turn in a negative quarter, falling 0.6%. With large technology companies outperforming, growth stocks generally outpaced value stocks in the first quarter. However, the performance gap between the two was narrower in the first quarter than in years past.

International stocks underperformed domestic equities again with the MSCI EAFE index rising 5.7% and the MSCI Emerging Markets index rising 2.1%. A strong US dollar weighed on returns; however, many economies showed signs of increasing strength. For instance, Japan made headlines several times during the quarter as its stock market surpassed its prior all-time high, which was set 34 years ago in December 1989. In late March, the Bank of Japan ended its eight-year stretch of negative interest rates as members of its rate-setting committee have taken a more hawkish stance.

Meanwhile, commodities were generally higher due to better economic growth expectations with not only crude oil higher, but gold also gaining over 7.0%.

Interest Rates

The 10-year Treasury rate ended the first quarter at 4.20%, about a third of one percent higher than the beginning of the year when the 10-year Treasury bond yielded 3.88%. This increase in longer-term interest rates caused the broader Bloomberg U.S. Aggregate Index to fall 0.8% during the first quarter. Intermediate-term bonds lost less than longer-term bonds and very short-term bonds gained in value. Riskier credit fared better as the U.S. Corporate High Yield Index was up 1.5% during the quarter.

Higher interest rates kept returns on REITs suppressed as the group fell by 1.3%.

Monetary Policy

With two Fed meetings occurring during the first quarter, the Fed continued to have a bias toward easing, but extended the time-frame for when cuts may occur to allow for further signs of inflation abatement. January and February both showed slightly higher inflation, so the markets have priced in a first possible interest rate cut during the summer months of June or July. Coincidentally, the futures markets now predict three cuts in all of 2024, which is the amount Fed governors anticipated late last year.

Chair Jay Powell reiterated several times that peak rates have been realized for this interest cycle. While unemployment has slowly increased, it is not at a level the Fed would like to see before cutting interest rates. On the other hand, the Fed senses that inflation is on a solid downward path close to the 2.0% goal. Investor and consumer sentiment have turned the corner as few mention an impending recession as had been the case over the last two years.

Keeping Focus on the Long-Term

While the upcoming presidential election is only one of many variables impacting the future economic and market landscape, rest assured that your team at Broadway Bank Wealth Management is always trying to help you achieve your long-term goals with no more risk than necessary.

For questions or comments on any of the topics included in this newsletter, please contact Broadway Bank’s Wealth Management team at [email protected].