Investment Management Newsletter - 2nd Quarter 2021

Will Prices Remain Elevated?

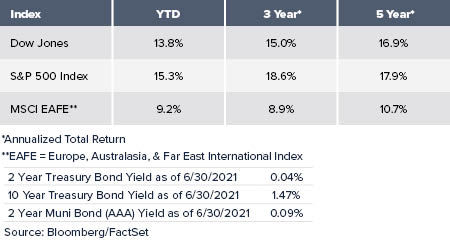

Despite two consecutive monthly inflation numbers that exceeded long-term averages, the S&P 500 continued its upward climb this quarter, notching an 8.6% gain between March and June. This leaves the index up 15.3% for 2021 thus far. Some question how long this strength can continue in the face of supply chain bottlenecks, pockets of rising costs, and higher inflation overall. At issue is what is causing this inflation, how long it might last, and what the expected impact on the markets might be.

Inflation is concerning because it can decrease standards of living for consumers and erode profit margins for corporations, not to mention increase borrowing costs as interest rates rise. At the risk of oversimplifying, inflation rises when demand increases more than supply. With economies reopening, demand for many items is increasing faster than projected. On the supply side, pandemic-induced shutdowns created logjams that will take some time to clear. In addition, labor shortages are putting upward pressure on wages in certain sectors which is also inflationary and could continue as unemployment moves toward its preCOVID levels from a high of 14.8% last spring versus 5.9% in June 2021. It is therefore no surprise that inflation is rising relative to levels of a year ago when the economy was largely closed. Year-over-year, the headline Consumer Price Index rose 4.2% in April and 5.0% in May, well above the oft mentioned 2% target. Much of this was related to energy with crude oil prices having increased from less than $20 per barrel in April 2020 to roughly $75 now. Recall, also, that inflation last touched 5% in August 2008 and stayed there for three months, yet turned negative a year later, demonstrating how today’s inflation levels can be poor predictors of inflation a year out.

The Federal Reserve has repeatedly claimed this inflation is “transitory,” though it is unclear how they define transitory. The Fed’s updated forecast now calls for inflation of 3.4% for 2021 which is higher than we have witnessed over recent years but well below the double-digit rates we saw in 1979 and 1980. Secular trends such as globalization, the effects of technology, and demographics are supportive of muted inflation longer-term, but other factors such as a weaker dollar, rising government debt levels, and bringing overseas production onshore could push inflation upward. We are likely seeing a mix of transitory and longer-term inflationary pressures.

Because investors can never be certain of the future trajectory for inflation, we have a number of inflation hedges in client portfolios. Equities are perhaps one of the best hedges because companies that can pass higher costs on to customers tend to outperform. Real estate values also increase with inflation which helped REITs return over 20% this year. Gold can also move with inflation but has not fared as well as other inflation hedges so far, having declined 6.1% in the first half.

Equities

If the stock market is concerned about inflation, it is not showing. The S&P 500 began the quarter by closing above 4,000 for the first time ever on April 1. This was quickly followed by the Dow Jones Industrial Average hitting 34,000 for the first time on April 15. With stocks up over 15% during just the first six months of the year, the market has already generated almost 150% more return than it does during an entire average year. Outperformance by mid- and small cap stocks has been even more dramatic with returns for those segments up 17.6% and 23.6% in the first half of the year, respectively. This stock market strength has now lasted five quarters, moving the bull market into its second year and pushing the S&P 500 92% above the bear market low of March 2020. Encouraging signs include strong earnings and healthy market breadth, as measured by the percentage of stocks that are increasing.

From a sector perspective, Energy has been the top performer this year with a 45.6% return, followed by Financials which are up 25.6% and Communication Services stocks which have increased 19.7%. Within those sectors, some of the best performers in our portfolios included Diamondback Energy, Chevron, Morgan Stanley, and Alphabet (Google). On the other extreme, sectors with softer relative performance this year have included Utilities, just 2.5% higher for the year, and Consumer Staples, up only 5.0%. Underperforming individual equities were Unilever, Coca Cola, Ecolab, Verizon, and Starbucks, all of which saw their share prices lower in the first half.

Within large caps overall, value stocks have outperformed growth stocks by four percentage points thus far during 2021, but growth regained the lead in the second quarter with outperformance of almost 7% as seen in the difference between the Growth and Value components of the Russell 1000.

Developed international and emerging market equity returns, while unusually strong at 9.2% and 7.4% year-to-date, respectively, have been more muted than domestic returns due to slower vaccine rollouts, an uneven economic reopening, and strength in the U.S. dollar.

Fixed Income and The Federal Reserve Bond returns have been less exciting than stock returns thus far. The Bloomberg Barclays Aggregate Index was up 1.83% for the quarter but remains down 1.60% for the year. The yield on the 10-year Treasury fell from 1.73% as of 3/31/21 to 1.47% as of 6/30/21, helping to support longer-term bond prices given that falling yields mean higher prices. Falling longer-term yields can indicate muted economic growth and lower inflation expectations. This supports the notion that inflation may be more of a short-term issue.

Unlike longer-term yields that are set by the market, short-term rates are a function of actions taken by the Federal Reserve. The Fed has kept its benchmark overnight federal funds rate near zero since March 2020. However, the Federal Open Market Committee announced in June that it will likely hike rates twice by the end of 2023. Higher short-term rates would help ensure that inflation remains transitory.

In Conclusion

As we look ahead, we expect stock market gains from here will be more muted than those we have experienced over the past year as the benefits from fiscal stimulus are fully realized and the post-pandemic economy normalizes. This part of the economic cycle tends to come with more volatility than immediate postrecession periods, but any pullbacks may also offer welcome investment opportunities.

Should you have any questions or comments, please email us at [email protected].

Written by Broadway Wealth Management's Portfolio Managers.