Investment Management Newsletter - 2nd Quarter 2023

Artificial exuberance

“Did a person write this newsletter or was it ChatGPT?” We can assure you this quarter’s newsletter is an old-school collaboration of humans—same as always.

Generative AI (artificial intelligence) has been a hot topic in the financial press over the last seven months. AI is a key focus area for many types of companies that will use it in attempts to boost productivity and profitability. The most popular chatbot, ChatGPT, was just released at the end of last November. One of the things it can do is produce an essay written in conversational style within seconds prompted by a single, simple question. The output could be at the first-grade or university reading level depending on how the prompt was phrased. As part of ChatGPT’s development, human trainers asked and answered a myriad of questions after which other trainers ranked the answers, allowing the chatbot to “learn” how best to answer questions posed to it. Many market pundits have described the changes AI will produce as revolutionary. Investing on the ground floor could transform the way many US businesses operate and has the clear potential to produce tremendous investment returns. At least that is what Softbank CEO Masayoshi Son believed when he launched the world’s biggest private investment fund six years ago. In 2018 he stated, “We are focusing on one theme, which is AI.” Years later, with over $140 billion invested in over 400 startups, Softbank has yet to see much, if any, return on its investments. The major beneficiaries of AI so far have been the established big techs, evidenced by their year-to-date returns: Microsoft +41%; Meta (parent of Facebook) +129%; and NVIDIA +196%. While Microsoft and Meta are household names, NVIDIA’s strong returns come from being the undisputed leader in the production of the powerful and complex chips needed to power AI.

Broadway’s Wealth Management clients have benefited from investment exposure to AI. While we feel that AI will be a major factor in the growth of many companies, we maintain our philosophy that proven earnings streams provide the best path to long-term capital appreciation. Students of market history may have noticed our allusion in the paragraph heading to then-Fed Chairman Alan Greenspan’s use of the now-famous term “irrational exuberance” in a 1996 speech, prophetically timed to coincide with the beginning of what became known as the dot.com bubble.

Stocks

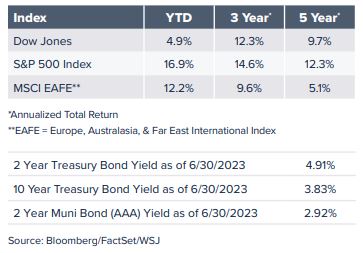

Stocks continued their first-quarter push to finish the first half higher with the S&P 500 up 16.9%, while the tech heavy Nasdaq Composite notched an impressive 32.0% gain. Consumer Discretionary, Communications Services, and Technology led the market higher. Lagging sectors were Financial Services, Health Care, Energy, and Utilities. The laggards represent Value sectors while the leaders are Growth sectors. The Russell 1000 Value Index was up 5.1% through the first half of the year while its Growth counterpart was up 29.0%.

Developed market international stocks represented by the MSCI EAFE returned 11.7% in the first half while emerging markets equities produced a 4.9% return.

Factors in the strong equity performance this year include the late stage of the Fed tightening cycle, AI enthusiasm, supply chain normalization, and declining energy prices.

Let’s pause here for some Fed talk

The most influential factor in many markets was the Federal Reserve’s actions. Market forecaster Marty Zwieg in 1970 coined the well-known phrase, “Don’t fight the Fed,” suggesting investors should not bet against the Fed achieving their goals. The Fed has been fighting postpandemic inflation since March 2022 with ten consecutive interest rate increases totaling 5.0%. Inflation has slowed, but the goal has yet to be reached. Falling from a peak of 9.1% a year ago, the Consumer Price Index is now at 4.0%. The Fed is making progress, but the fight is not over. The fear of recession has diminished as the Fed is seemingly on track for a soft landing where inflation is brought under control without a rise in unemployment or a recession, though we have not yet reached their 2% inflation target. At the June 14th meeting, Fed governors decided to pause rate increases to allow time for the effects of their actions to take hold and to evaluate their effectiveness. Fed Chair Powell rattled the market in his press conference following the pause stating, “Looking ahead, nearly all committee participants view it as likely that some further rate increases will be appropriate this year to bring inflation down to two percent over time.” Markets tend to look at least 12 months ahead in valuing stocks. This time next year, expectations are the tightening cycle will be over, and we could be in a rate-cutting cycle by then.

Fixed income

Bonds have fared better in 2023 than last year, but 2022 sets a low bar indeed. It was the worst year for bonds in the history of the Bloomberg U.S. Aggregate Index which was down 13.0%. Returns for the first half of 2023 are up 2.1% for the Aggregate and 2.7% for the Bloomberg Municipal Bond Index. The Fed is still tightening and thus creating headwinds for bonds, but the tightening cycle appears to be in the later innings. One bright spot in the fixed income space is short-term rates. Money market funds are now yielding around 5% for cash-like investments—a level we haven’t seen in 16 years.

Alternative assets

Alternatives with lower correlations to traditional stocks and bonds can be a drag on performance during strong bull markets as they have been so far in 2023, though they can be effective diversifiers in times of market volatility. Hedge funds have been virtually flat for the first half while gold was up 4.9%, and oil finished the first half down about 12% at just over $70 a barrel for West Texas Intermediate Crude.

Finally

To try it out, we asked ChatGPT to write this market commentary, and the response was, “As an AI language model, I don’t have real-time data or the ability to browse the internet. My training only goes up until September 2021, so I cannot provide you with specific information about what happened in the stock market in 2023.” ChatGPT went on to say, “To get information about what happened in the stock market in 2023, I recommend referring to reliable financial news sources, consulting with financial advisors, or conducting research using financial market analysis platforms.” That is advice we can agree with. For a discussion with live Wealth Advisors and Portfolio Managers you can always count on Broadway Wealth Management.

Should you have any questions or comments, please email us at [email protected].