Investment Management Newsletter - 4th quarter 2023

Against Great Odds

Economist John Kenneth Galbraith once commented, “The only function of economic forecasting is to make astrology look respectable.” This sentiment was certainly strengthened by the events of the past year. Entering 2023, more than 85% of economists surveyed expected a U.S. recession before year-end. They had good reason to feel this way. The Federal reserve had embarked on the fastest rate hiking cycle in decades, inflation was eroding purchasing power, excess savings were drying up, the yield curve was inverted and the stock market was in the midst of the worst bear market since 2009.

Despite the doom and gloom prognosticators were bracing for, they couldn’t have been more wrong. Instead, a recession was avoided as inflation kept falling, consumers continued spending, the unemployment rate fell to its lowest level since 1969 and stocks ended a banner year near record highs. Of course, 2023 wasn’t totally without turmoil as soaring interest rates caught several regional banks off guard. At Silicon Valley Bank, a rapid loss of deposits and a sharp drop in the value of its bond portfolio eventually triggered a bank run. First Republic Bank and other lenders also collapsed, evoking memories of the great financial crisis over a decade ago. The crisis left investors on edge that something else in the financial system was sure to break. The Fed, however, quickly restored confidence declaring that depositors wouldn’t lose the money they had stashed away in the troubled lenders, which stemmed further bank runs and averted the risk of a deeper catastrophe.

“Everything” Rally

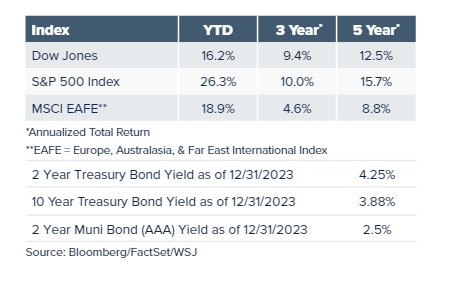

For most investors, 2023 marked a welcomed rebound in both stock and bond performance after a brutal 2022; and those who stayed invested were rewarded, as all major asset classes, with the exception of commodities, experienced positive total returns. U.S. large cap stocks, measured by the S&P 500, led the rebound with a 26.3% return, as enthusiasm over artificial intelligence (AI) propelled mega cap technology stocks to lofty valuations. Small cap stocks, represented by the Russell 2000, also performed well, climbing 16.9%, reflecting resilient domestic consumption and beaten-down valuations early in the year. Outside the U.S., better-than-expected progress on inflation in Europe and resilient earnings boosted gains to 18.9% (MSCI EAFE) for developed market stocks. Emerging market stocks (MSCI Emerging Markets) rose a more muted 10.3% as a downturn in China offset gains in India, Taiwan and Korea.

Bond investors breathed a sigh of relief after avoiding an unprecedented third straight year of losses. Even bonds with lower credit ratings posted healthy returns, driven by resilient fundamentals and only a moderate increase in defaults. Meanwhile, the broader bond market rallied the last two months of the year, with the Bloomberg U.S. Aggregate Bond Index up 5.5% as investors were comforted by the Fed’s dovish policy shift.

Within alternative investments, gold rose 13.5% and ended the year near record highs, amid concerns over geopolitical risk and a lower U.S. dollar. Real estate investment trusts rebounded to an 11.4% gain on the back of strong demand for data centers and hopes for lower long-term interest rates. Broad commodities, in a stark reversal from 2022, fell by 7.9%, ending the year as the poorest-performing asset class due to a sluggish economy in China and a 10.7% decline in the price of oil.

Magnificent Seven and a Narrow Market

Undoubtedly the most pervasive theme in the stock market this year was the rise of the “Magnificent Seven” growth stocks and the resulting narrow leadership in the S&P 500 index. These stocks – Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla – each gained more than 48.0% for the year and their combined weight comprised 28% of the S&P 500’s total market capitalization. According to S&P Dow Jones Indices, excluding these seven stocks, the S&P 500’s annual return was only 9.9%. In other words, the Magnificent Seven accounted for nearly two-thirds of the index’s 2023 performance. The dominance of mega cap growth stocks this year was further evidenced in that just 29% of stocks outperformed the S&P 500 this year, the lowest number since 1998, and the median stock lagged the index by 16% (Source: Grindstone Intelligence).

Fed Policy and Bond Yields

Far and away the biggest story for financial markets in 2023 was Fed policy. After four quarter-point interest rate hikes, at their December meeting, Fed officials signaled that no additional increases were expected. In addition, as the risks of inflation and slower growth became more balanced, they signaled the potential to lower rates in the coming year. Since the last rate hike in July, the Fed’s preferred inflation measure, the Core Personal Consumption Expenditures index, fell to 3.2% year-over-year in November from 4.9% at the start of 2023. Meanwhile, as inflation trended lower, the U.S. labor market remained robust despite rising interest rates. For the year, payrolls rose a solid 225,000 jobs per month and the unemployment rate remained at 3.7%. The experience of 2023 has defied the traditional view of an inevitable trade-off between inflation and unemployment.

Although ending the year with gains, the overarching theme in the bond market this year was interest rate volatility. After beginning the year at 3.88%, the 10- year Treasury yield fell more than 0.5% to 3.31% in April due to the regional banking crisis. While some expected the Fed to cut rates in response, they instead utilized targeted liquidity measures to shore up the banking sector. From there, resilient economic data and heavy Treasury issuance led to a significant move up in rates, with the 10-year yield rising 1.68%, peaking in late October at 4.99%, its highest level since 2007. Nevertheless, the spike in rates was short-lived as one of the strongest year-end rallies in decades ensued over the final two months. The 10-year yield fell 1.11% to end the year at 3.88%, completing the round trip. Supporting the late-year rally was data showing the job market was finally moderating and the Fed confirming the potential for a pivot to rate cuts in 2024.

Keeping Focus on the Long-Term

If the recession expectations at the beginning of 2023 came with any lesson, it was that the economy and markets can surprise us. Therefore, investors would be better off not trying to time the market. As we enter 2024, the new year presents its own set of unknowns: expanding geopolitical concerns, a presidential election, and the question of whether the Fed will stick the soft landing. Regardless of the economic landscape, please rest assured that your wealth management team remains committed to helping you achieve your long-term financial goals.

For questions or comments on any of the topics included in this newsletter, please contact Broadway Bank’s Wealth Management team at [email protected].